Tax Credits and Deductions Maximizing Opportunities for Savings

Tax credits differ from deductions because they reduce actual taxes owed dollar for dollar. These tax breaks are a great opportunity for small businesses and individuals to lower their …

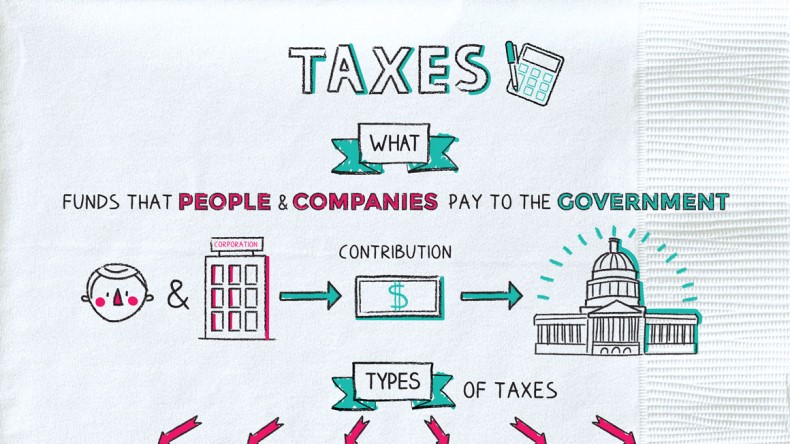

Read MoreUnderstanding Different Types of Taxes

Learn about taxes on what you earn, what you buy, and what you own. Some are paid directly to the government. Others are collected on your behalf by businesses.

Many states …

Read MoreNavigating Tax Season – Essential Tips for Individuals and Businesses

During this tax season, the right tools can help make the process easier and less stressful. For example, keeping a detailed log of business expenses throughout the year allows individuals …

Read MoreFinancial Planning for Entrepreneurs Mapping Out Your Business Future

Entrepreneurs are always working to ensure that business aspects like cash flow and budgeting are in order. However, personal financial planning often takes a backseat, and this can have negative …

Read MoreThe Importance of Budgeting in Business

Effective budgeting is a crucial step in maintaining financial control for a business. It can help businesses estimate revenue, expenditure and expected profits.

Monitoring the variance between actual and budgeted …

Read MoreUnderstanding Financial Ratios Key Metrics for Evaluating Business Performance

Financial ratios use numerical values derived from financial statements (balance sheet, income statement and cash flow statement) to analyze business performance. They are an essential tool for quantifying business performance.

The …

Read MoreEssential Tools and Software For Financial Success

Keeping up with the financial side of running a business can feel like a never-ending task. Fortunately, affordable tech tools can save you time and headaches by automating some of …

Read MoreEffective Cost Management Strategies for Controlling Expenses and Boosting Profitability

Effective cost management techniques can improve your business’s profits and increase the visibility of costs. This includes establishing budgets that limit unnecessary spending.

It is also important to separate your …

Read MoreDemystifying Bookkeeping A Beginners Guide to Accounting Basics

Accounting can be overwhelming, especially to small business owners. This guide demystifies bookkeeping and other accounting concepts without the use of confusing jargon.

From analyzing expenses to understanding earnings statements …

Read MoreFinancial Management Tips For Small Businesses

A lack of financial management is one of the leading reasons for small business failure. Without a good system, expenses can overtake revenue and bank accounts can run dry.

Sound Read More