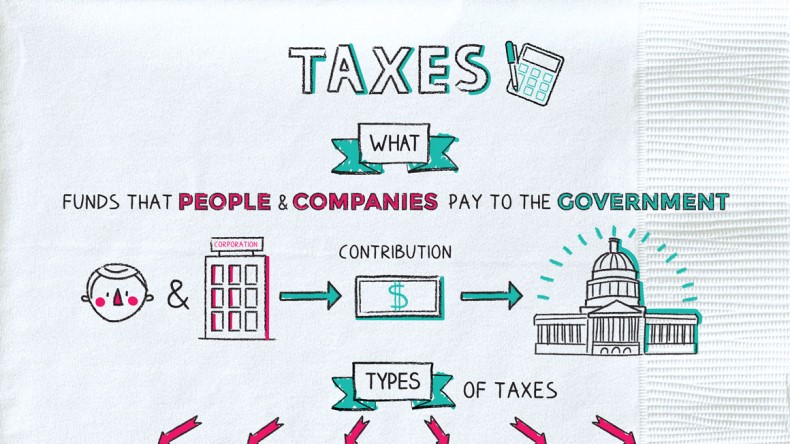

Understanding Different Types of Taxes

Learn about taxes on what you earn, what you buy, and what you own. Some are paid directly to the government. Others are collected on your behalf by businesses.

Many states have consumer excise taxes in which sellers bear the legal burden for collecting and remitting sales tax. In contrast, property taxes are a major revenue source for local governments.

Income Tax

A tax is a fee that citizens or corporations pay to an authority. The purpose of taxes is to fund public services such as roads, national defense and education. Types of taxes include income, sales, capital gains, property, excise and inheritance.

The most familiar of these is the federal and many state income taxes that you see deducted from your paycheck. Those taxes help to fund public services such as Medicare and Social Security.

Individual income taxes are levied on wages, salaries, investments and other forms of personal income. In most states, the tax is progressive and rates increase as income rises.

A sales tax is a consumption tax that can be levied at the federal, state and local levels on goods and services. This can be in the form of a value-added tax (VAT), a goods and service tax, a state or municipal sales tax, or an excise tax. Sales taxes can be regressive, meaning that lower-income individuals and households pay a greater percentage of their income in taxes than higher-income residents.

Sales Tax

Sales taxes are a type of consumption tax that is levied by state and local governments on the retail sale of goods and services. They are a key source of revenue for many states, and can also be levied at the county and city level in some jurisdictions.

Most states operate under consumer excise or destination sales tax models, in which the primary responsibility for paying the tax rests with purchasers of taxable goods and services. Sellers serve primarily as collection agents, and don’t have the option of absorbing the tax.

The tax is often applied to items purchased from outside a state’s boundaries, in order to prevent shoppers from avoiding sales taxes through various shopping strategies. It is also a major contributor to the cost of shipping and handling charges. Keeping up with the rules and rates can be challenging, especially as a business grows. But it’s essential to understand these taxes in order to ensure compliance and visibility into a company’s costs.

Property Tax

The property tax is levied by your local government based on the value of your home or other real estate. You may pay this tax directly or it is often included in your mortgage payment. Property taxes also apply to other types of real estate and tangible personal property like tools and equipment.

Property taxes conform to the “benefit principle,” meaning that the taxes you pay should correlate to the benefits you receive from the services your tax dollars fund. These benefits can include public education, fire protection and police and other vital government services.

Your state or local governments set and administer property tax rates, policies and payment terms that can differ from one area to another. You can find more information about property tax rates and other laws at your local government website. You can also call your county or city tax assessor for more details about how property taxes are administered in your area.

Other Taxes

There are many different types of taxes imposed by federal, state, local and special-purpose government jurisdictions. In general, these taxes are based on the type of income you earn or the value of the property and land you own. Some are progressive, meaning that as your taxable income increases, so does the tax rate.

Another popular type of tax is the sales tax, a consumption tax based on the retail price of many goods and services. Some states also have a use tax, which is a similar tax on the storage, use or consumption of taxable items purchased outside the state without paying sales tax.

Local governments rely heavily on property taxes, which are levied on real estate and tangible personal property like machinery and equipment. This is often a classic ad valorem tax, where the property is assessed based on its “highest and best use.” Some jurisdictions tax business personal property as well. For example, many businesses have to pay a property tax on their office furniture and equipment.